Our Quick Access Phone Numbers:

+90 (542)

666 11 11

+90 (532)

345 49 86

Mail : info@drgmakina.com

Electric Motor Prices 2026 – Market Outlook and Key Factors

Electric motor prices in 2026 are influenced by several global and local market dynamics, including raw material costs, energy-efficiency standards, and supply chain conditions. As industrial demand continues to grow, especially in sectors such as manufacturing, mining, HVAC, and automation, motor pricing trends reflect both technological improvements and increased material expenses.

1. Raw Material Cost Increases

Copper, electrical steel, aluminum, and cast-iron prices remain the main cost drivers. Any fluctuation in global metal markets directly affects the final price of IE2, IE3, IE4, and IE5 class motors. In 2026, moderate increases in copper and steel demand are expected to keep motor prices higher compared to previous years.

2. Shift Toward Energy-Efficient Motors

Regulations and industrial demand are pushing companies toward IE3, IE4, and IE5 high-efficiency motors.

These motors offer long-term energy savings but typically have higher upfront costs due to:

-

Premium-grade magnetic steel

-

Improved rotor designs

-

Higher quality copper windings

-

Advanced insulation materials

As a result, 2026 prices for high-efficiency motors are expected to remain above standard models.

3. Impact of Global Supply Chain

Transportation, import taxes, and exchange rates continue to play a major role in motor pricing. Imported motors show greater price volatility, while locally manufactured motors offer more stable pricing and faster delivery times.

4. Expected Price Ranges for 2026 (General Estimates)

Prices vary based on power (kW), efficiency class, and frame type:

-

Small motors (0.37–3 kW):

Affordable range, suitable for pumps, fans, small machinery. -

Medium power motors (4–75 kW):

Most commonly used in industrial plants; prices vary widely depending on efficiency. -

Large motors (90–355 kW and above):

High-torque and heavy-duty motors show significant price differences based on brand and construction type.

Although specific numbers differ between brands, 2026 pricing is generally expected to be 5–12% higher than in 2025 due to material and logistics costs.

5. Local Market Advantage (Turkey)

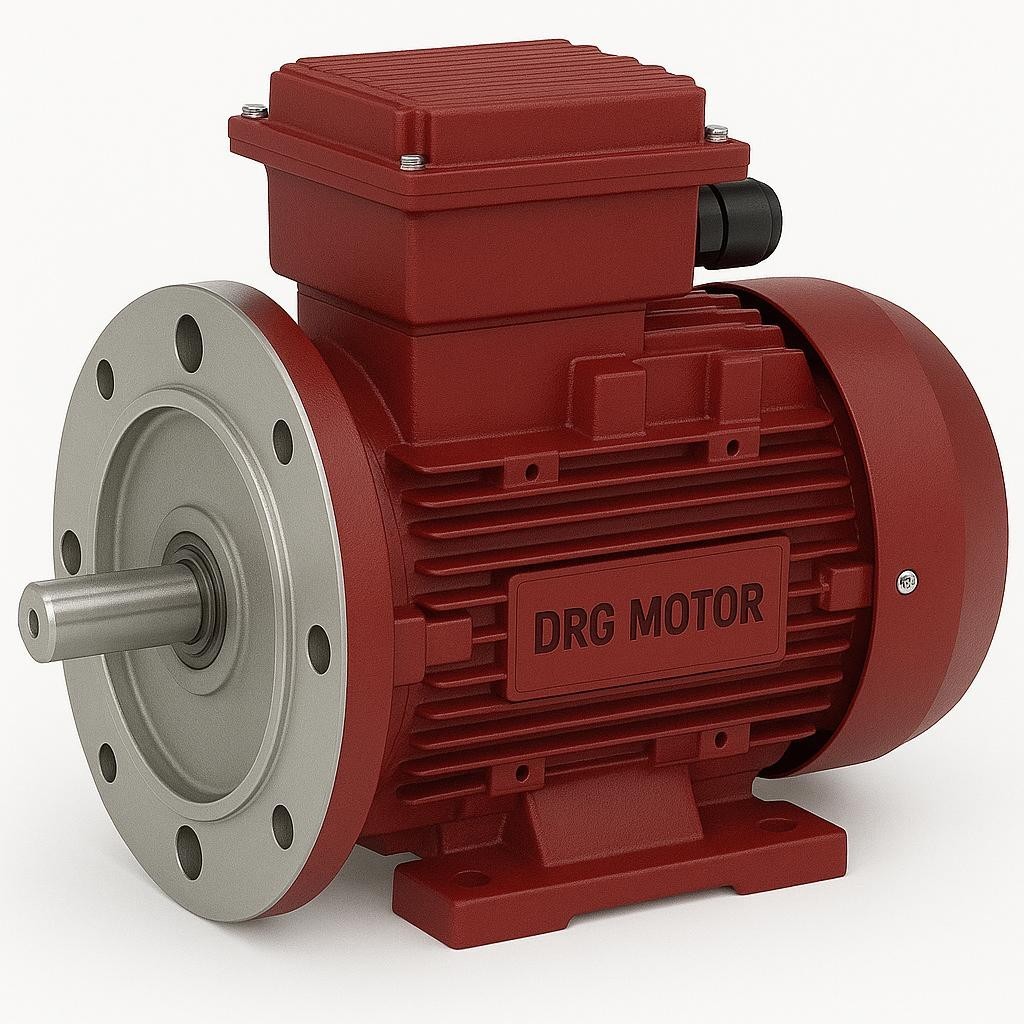

In Turkey, brands like DRG MOTOR offer competitive pricing thanks to local production advantages, reduced import dependency, and faster stock delivery. This provides industries with cost-effective and reliable options, especially in the IE3–IE5 segments.

English

English

Türkçe

Türkçe